Florida’s Property Insurance Market: Signs of Stability After Years of Turbulence

/For much of the past decade—especially between 2019 and 2023—Florida’s property insurance market was defined by instability. Rapidly rising premiums, shrinking carrier appetites, insolvencies, and limited consumer choice became the norm. Homeowners and auto policyholders alike experienced consecutive years of double‑digit rate increases, often with few alternatives available.

Today, that narrative is finally changing.

Thanks in large part to significant legislative reforms enacted in 2023, Florida’s insurance market is showing clear signs of stabilization. At Dockside Insurance Group, we’re seeing these changes firsthand—and more importantly, we’re seeing opportunities for consumers that simply didn’t exist a few years ago.

The Impact of 2023 Tort Reform on Florida Insurance

The legislative reforms passed in 2023 were designed to address one of the most destabilizing forces in Florida insurance: excessive litigation.

Key elements of the reform package included:

Limits on one‑way attorney fees

Curtailment of assignment‑of‑benefits (AOB) abuse

Clearer standards around bad‑faith litigation

Greater predictability in claims outcomes

While these reforms didn’t produce overnight results, they sent an immediate signal to insurers and reinsurers that Florida was serious about restoring balance to its insurance ecosystem.

A Softening Property Insurance Market

As a result of these reforms, the Florida homeowners insurance market is now beginning to soften.

We are seeing:

New homeowner’s carriers entering or re‑entering Florida

Existing carriers expanding underwriting appetite

Increased competition for well‑maintained, loss‑free homes

This renewed competition matters. When insurers compete for business, pricing pressure eases—and consumers benefit.

Reinsurance Capital Is Returning

Reinsurance plays a critical role in Florida’s insurance pricing. For years, constrained global reinsurance capacity was one of the biggest drivers of premium increases.

That trend is reversing.

More reinsurance capital is now being deployed into the Florida market, driven by:

Improved litigation outlook

More predictable loss modeling

Greater confidence in long‑term market stability

As reinsurance pricing moderates, primary carriers are able to reduce their own rate pressure—creating a downstream benefit for homeowners.

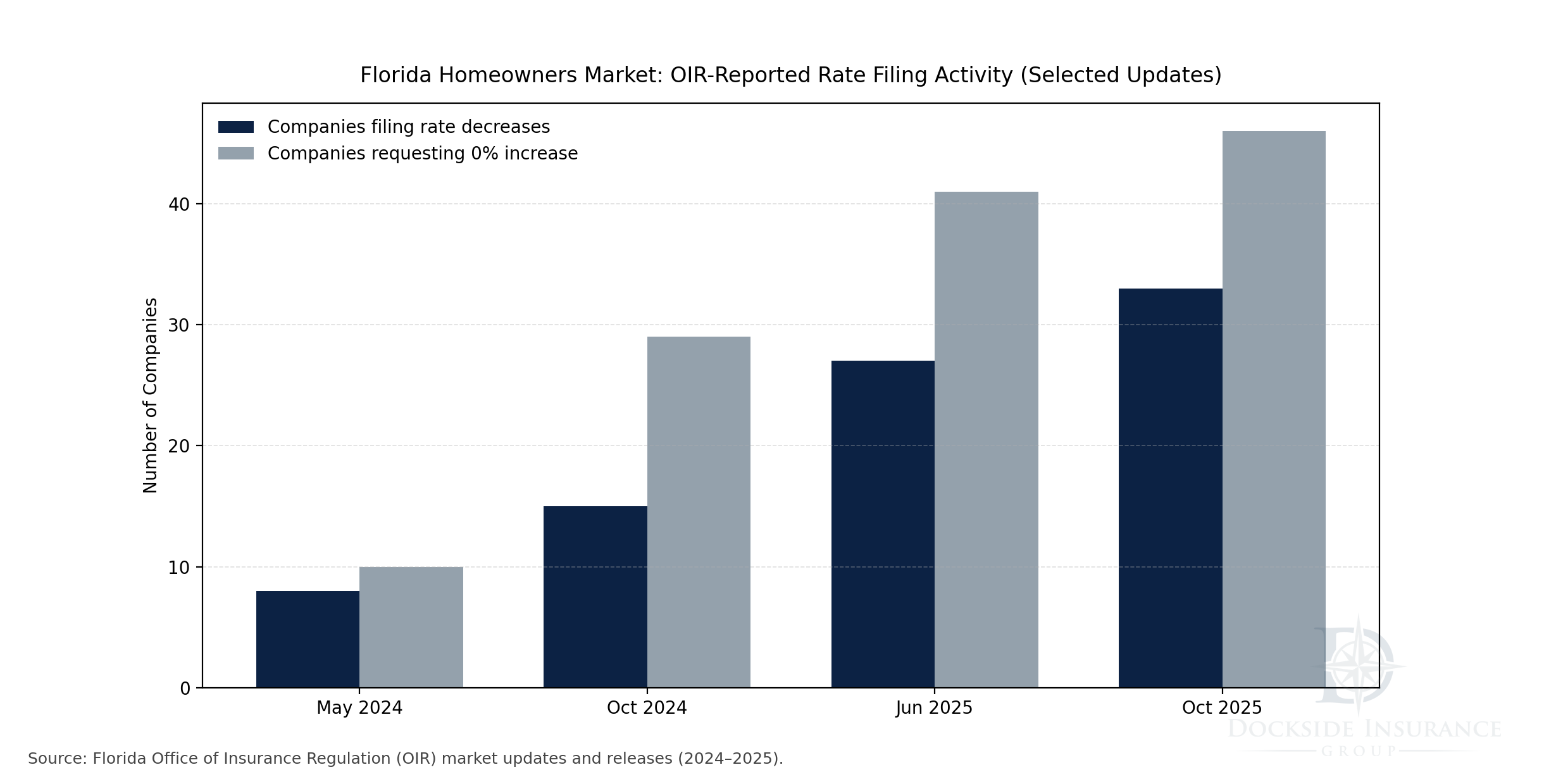

Rate Decreases Approved by the Florida OIR

Perhaps the most tangible sign of improvement: rate decreases are being approved by the Florida Office of Insurance Regulation (OIR).

While not every policyholder will see an immediate reduction, the broader trend is clear:

Rate filings are flattening or declining

Increases, when approved, are smaller and more targeted

Across‑the‑board double‑digit hikes are becoming far less common

This represents a meaningful shift from the environment Floridians experienced just a few years ago.

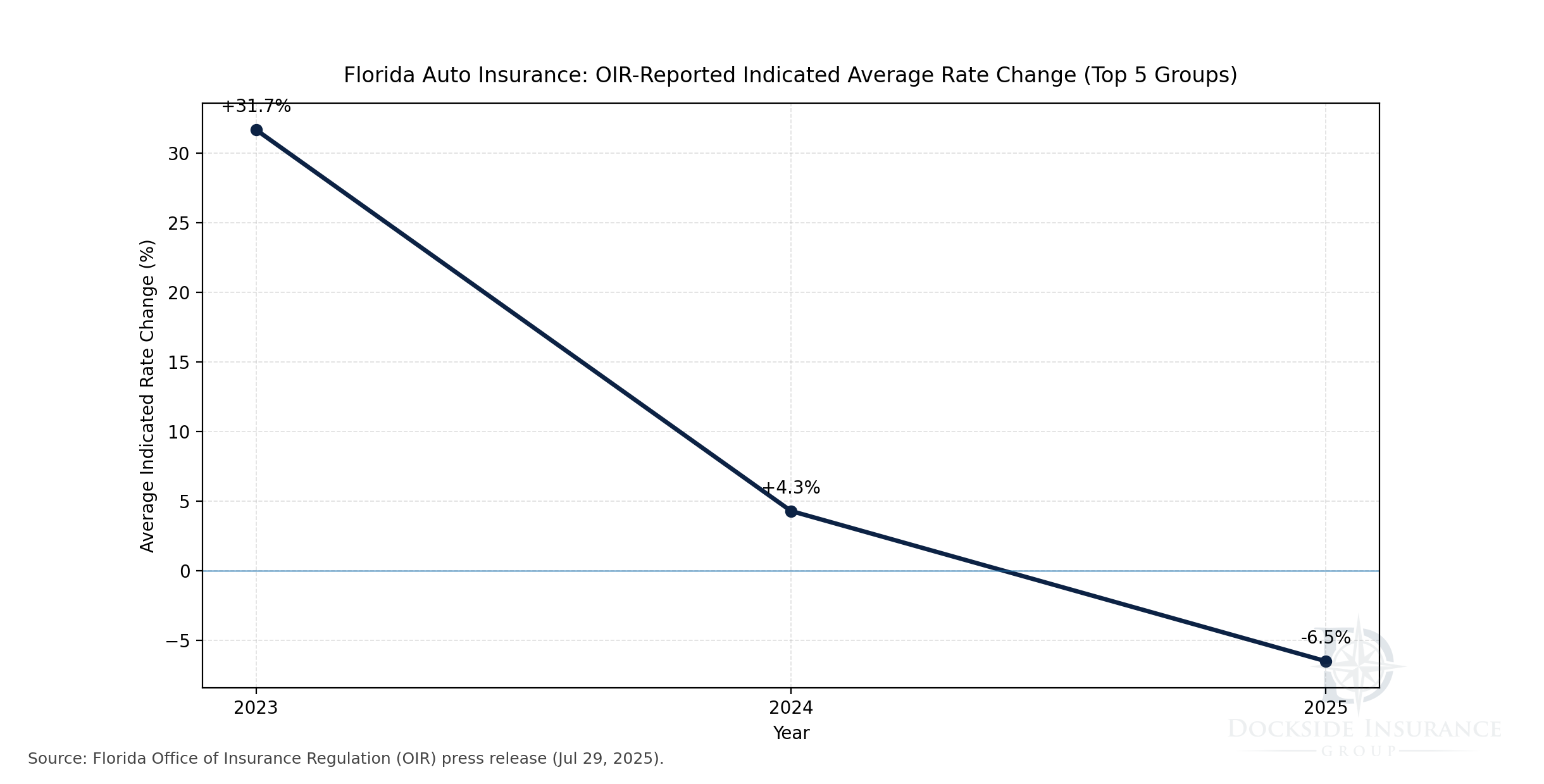

What About Auto Insurance?

Auto insurance is also showing signs of stabilization.

For several years, auto premiums rose sharply due to:

Litigation trends

Medical cost inflation

Supply‑chain disruptions

Vehicle repair and replacement costs

Those pressures haven’t disappeared—but they are no longer accelerating at the same pace.

Today, auto rate changes are increasingly driven by broader U.S. inflationary factors, not Florida‑specific dysfunction. In many cases, rate increases are smaller, more predictable, and easier to shop effectively.

Why This Matters If You Haven’t Shopped in Years

If your homeowner’s, auto, or flood policy has been in force for several years, there’s a strong chance it was priced during one of the most volatile periods Florida has ever seen.

That means:

Your policy may reflect outdated risk assumptions

You may be paying for market conditions that no longer exist

Better‑priced or better‑structured options may now be available

With a stabilizing market, this is one of the best times in years to review your coverage.

Now Is the Time to Re‑Shop Home, Auto, and Flood Insurance

At Dockside Insurance, we work with a wide range of admitted and specialty carriers—and we stay closely aligned with regulatory and market developments in Florida.

Whether it’s:

Homeowner’s insurance

Auto insurance

Flood insurance

Now is the right moment to take a fresh look.

Markets change. Laws change. Pricing changes.

If you haven’t reviewed your policies recently, we’d welcome the opportunity to help ensure you’re not paying more than you need to for the coverage you deserve.

Better days are ahead for Florida insurance—and we’re here to help you take advantage of them.